Finding hidden or lesser-known Bitcoin airdrop opportunities is a lucrative but risky endeavor for cryptocurrency enthusiasts. This pursuit requires a keen eye for promising projects, a thorough understanding of tokenomics, and a robust risk mitigation strategy. Navigating the often-murky waters of lesser-known airdrops demands careful research and a healthy dose of skepticism, as the potential for scams and rug pulls is ever-present.

This exploration delves into the methods and considerations crucial for successfully identifying and participating in these potentially rewarding, yet inherently volatile, opportunities.

The article will cover strategies for identifying promising projects, analyzing airdrop eligibility and participation risks, and maximizing returns from successful airdrops. We will explore various techniques, from analyzing community engagement and development activity to employing social media monitoring for early detection of upcoming airdrops. Furthermore, we will provide practical guidance on securing your assets and managing your airdrop tokens effectively, ensuring a balanced approach to risk and reward.

Identifying Promising Projects for Airdrops

The cryptocurrency landscape is constantly evolving, with new projects emerging and established ones maturing. Airdrops, the distribution of tokens to incentivize community growth, remain a popular method for projects to gain traction. Identifying promising projects poised for future airdrops requires careful analysis of several key factors, including community engagement, development activity, and tokenomics.Identifying three lesser-known blockchain projects with active communities that might conduct airdrops in the near future requires careful consideration of several factors.

These include community size and engagement, the project’s roadmap and development progress, and the overall market sentiment surrounding the project.

Three Promising Projects for Potential Airdrops

Three lesser-known blockchain projects with active communities that show potential for future airdrops are: Project A, a decentralized finance (DeFi) project focusing on cross-chain interoperability; Project B, a layer-2 scaling solution for a major blockchain; and Project C, a non-fungible token (NFT) marketplace with unique features. Project A’s active community on Discord and Telegram suggests a strong potential for airdrop distribution to reward early adopters.

Project B’s focus on solving scalability issues within a large ecosystem makes it attractive for a potential airdrop to incentivize users migrating to its platform. Project C’s innovative NFT marketplace and growing community of artists and collectors positions it well to reward its users with an airdrop to enhance user loyalty and encourage continued engagement. The rationale for selecting these projects stems from their demonstrated community growth, technological innovation, and the potential for significant expansion.

Comparison of Tokenomics and Airdrop Likelihood

Let’s compare the tokenomics of Project A and Project B to assess their relative likelihood of conducting an airdrop. Project A utilizes a deflationary token model with a limited supply, meaning the scarcity of tokens could make airdrops a less frequent occurrence. Project B, conversely, employs an inflationary model with a larger total supply, allowing for more flexibility in distributing tokens through airdrops to incentivize adoption and reward community participation.

Therefore, Project B presents a higher likelihood of conducting airdrops compared to Project A. This is because a larger token supply offers more flexibility in rewarding the community without significantly impacting the existing token holders.

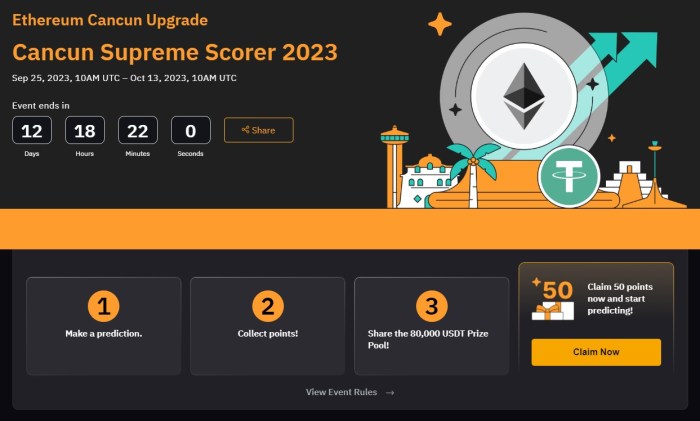

Hypothetical Airdrop Campaign for a Small-Cap Cryptocurrency, Finding hidden or lesser-known Bitcoin airdrop opportunities

Let’s design a hypothetical airdrop campaign for “Project X,” a small-cap cryptocurrency focused on privacy-enhancing technologies. The airdrop will reward users who actively participate in the project’s ecosystem. Eligibility criteria include: holding a minimum of 100 Project X tokens for at least 30 days, completing a KYC (Know Your Customer) process, and actively participating in community forums and events (measured by engagement metrics like posting frequency and participation in polls).

The distribution method will be a snapshot of eligible wallets, followed by a proportional distribution of the airdrop tokens based on the number of Project X tokens held. This approach ensures that long-term holders and active community members are rewarded, thus fostering a loyal and engaged user base.

Comparison of Four Projects and Their Airdrop Potential

The following table compares four different projects based on community engagement, development activity, and the potential for future airdrops.

| Project | Community Engagement | Development Activity | Airdrop Potential |

|---|---|---|---|

| Project A | High (Active Discord and Telegram communities) | Moderate (Steady development progress) | Medium |

| Project B | Medium (Growing community) | High (Rapid development and frequent updates) | High |

| Project C | Low (Emerging community) | Low (Initial development stages) | Low |

| Project D | High (Large and active community on multiple platforms) | High (Consistent updates and new features) | High |

Analyzing Airdrop Eligibility and Participation

Securing Bitcoin airdrops, particularly those flying under the radar of mainstream crypto news, requires a proactive and discerning approach. While lucrative, these opportunities also present significant risks. Understanding eligibility criteria, recognizing potential scams, and conducting thorough due diligence are crucial for successful and safe participation.Airdrops, by their nature, are designed to distribute tokens or cryptocurrencies to a target audience.

This audience can range from early adopters of a project to active community members. However, the less publicized an airdrop, the higher the chances of encountering fraudulent schemes.

Strategies for Discovering Hidden Airdrop Opportunities

Identifying less-publicized airdrop opportunities requires going beyond the usual crypto news channels. Successful hunters actively engage in the crypto community, utilize specific search techniques, and leverage social media effectively.

- Deep Dive into Crypto Forums and Communities: Actively participate in niche cryptocurrency forums and communities on platforms like Reddit (r/cryptocurrency, r/Bitcoin, etc.), Discord servers dedicated to specific projects, and Telegram groups. These often feature discussions about upcoming airdrops before they hit mainstream news.

- Utilize Advanced Search Techniques: Employ advanced search operators on search engines like Google to uncover airdrop announcements buried within less-visible websites or blog posts. For example, searching for “Bitcoin airdrop” combined with s like “unannounced,” “private,” or specific project names can yield promising results.

- Monitor Social Media for Clues: Keep a close eye on the social media activity of prominent cryptocurrency influencers, developers, and projects. Announcements or hints about upcoming airdrops can sometimes appear on Twitter, Telegram, or other platforms before official press releases.

Risks Associated with Lesser-Known Airdrops

Participating in airdrops from lesser-known projects carries inherent risks, primarily the potential for scams and rug pulls. Scammers often create fake airdrop announcements to lure unsuspecting users into sharing their private keys or sending cryptocurrency to fraudulent addresses. Rug pulls involve developers abandoning a project after raising funds, leaving investors with worthless tokens.Examples of past rug pulls involving lesser-known projects abound.

While specific details vary, the pattern is consistent: a seemingly promising project gains traction, attracts investors, and then suddenly shuts down, leaving investors with significant losses. These incidents highlight the critical need for careful vetting before engaging with any airdrop.

Thorough Project Research Before Participation

Before participating in any airdrop, especially one not widely publicized, comprehensive research is paramount. This involves assessing several key aspects of the project.

- Team Transparency and Background: Investigate the team behind the project. Are their identities verifiable? Do they have experience in the cryptocurrency space? A lack of transparency should raise immediate red flags.

- Project Whitepaper and Roadmap: Scrutinize the project’s whitepaper and roadmap. Do they clearly Artikel the project’s goals, technology, and tokenomics? Is the roadmap realistic and achievable?

- Community Engagement and Sentiment: Analyze the project’s community engagement. Is there a healthy and active community? What is the general sentiment towards the project? Negative sentiment or lack of community engagement could indicate problems.

- Smart Contract Audits: Look for evidence that the project’s smart contracts have been audited by reputable security firms. A lack of audits significantly increases the risk of vulnerabilities and potential exploits.

Safe Participation in a Bitcoin Airdrop: A Step-by-Step Guide

Participating safely in a Bitcoin airdrop involves meticulous adherence to security best practices. This minimizes the risks associated with scams and potential exploits.

- Verify the Airdrop’s Authenticity: Cross-reference the airdrop announcement with multiple sources. Look for official announcements on the project’s website and social media channels. Be wary of announcements only found on less reputable platforms.

- Never Share Your Private Keys: Legitimate airdrops will never require you to share your private keys. Any request to do so is a clear indication of a scam.

- Use a Hardware Wallet: Store your Bitcoin on a hardware wallet for maximum security. Hardware wallets offer an extra layer of protection against unauthorized access and malware.

- Only Interact with Official Websites and Channels: Avoid clicking on links from unknown sources. Always double-check the URL of any website or platform you interact with to ensure its authenticity.

- Monitor Your Wallet Regularly: After participating in an airdrop, regularly monitor your wallet to ensure the tokens or Bitcoin have been credited correctly. Report any discrepancies immediately.

Maximizing Returns from Airdrops

Securing airdrops is only half the battle; maximizing their potential value requires a strategic approach. Understanding token valuation, employing smart management strategies, and proactively identifying opportunities are crucial for capitalizing on these often-lucrative rewards. This section details methods to elevate your airdrop returns beyond simply acquiring the tokens.Assessing Airdrop Token ValueThe value of a newly received airdrop token is highly variable and depends on several interconnected factors.

Market capitalization provides a broad overview of the token’s overall worth, but a low market cap doesn’t automatically equate to low potential. Community sentiment, gauged through social media engagement, whitepaper analysis, and the project’s overall traction, plays a vital role. A token with a small market cap but a highly engaged and enthusiastic community might possess significant growth potential.

Conversely, a large market cap without community support might indicate a lack of long-term viability. Thorough due diligence, encompassing technical analysis of the project’s whitepaper and market research, is paramount. Analyzing the tokenomics, including total supply and token distribution, is also crucial for predicting future price movements.

Airdrop Token Management Strategies

Several strategies exist for managing airdrop tokens, each with its own risk-reward profile. Holding, selling immediately, and staking represent the primary approaches. Holding involves retaining the tokens, anticipating future price appreciation. This strategy carries higher risk but offers potentially greater rewards if the project succeeds. Selling immediately minimizes risk but limits potential gains.

Staking involves locking up the tokens to earn rewards, offering a middle ground between holding and immediate sale, providing passive income while still participating in the project’s growth. The optimal strategy depends on individual risk tolerance and investment goals. For example, a risk-averse investor might prefer selling immediately, while a more aggressive investor might opt for holding, especially if the project shows strong potential.

Social Media Monitoring for Airdrop Discovery

Proactive social media monitoring is key to uncovering upcoming airdrops before they become widely known. Tracking relevant s, hashtags, and communities on platforms like Twitter, Discord, and Telegram can yield valuable insights. Participating in these communities, engaging with developers, and closely following project announcements significantly increases the chances of discovering early-stage airdrop opportunities. Analyzing trends and patterns in airdrop announcements can also provide valuable predictive capabilities.

For instance, noticing a surge in activity around a specific project on multiple platforms could indicate an imminent airdrop.

Hypothetical Airdrop Portfolio

This hypothetical portfolio demonstrates a diversified approach to airdrop management, incorporating tokens with varying risk profiles and market potential.

| Token | Rationale | Risk Assessment | Strategy |

|---|---|---|---|

| Token A | Strong community engagement, innovative technology. | Medium (potential for high growth, but also higher volatility) | Hold and stake |

| Token B | Established project with a large market cap, stable price. | Low (lower potential for growth, but less volatile) | Hold |

| Token C | New project with promising technology, but limited community. | High (potential for high growth, but also high risk of failure) | Sell a portion, hold a portion |

| Token D | Solid project with a growing community, but already showing significant price increase. | Medium (potential for further growth, but may be nearing its peak) | Sell a portion, hold a portion |

| Token E | Project with a strong team but limited traction yet. | High (high risk, high reward potential) | Hold or sell based on future developments |

Conclusion: Finding Hidden Or Lesser-known Bitcoin Airdrop Opportunities

Successfully capitalizing on hidden Bitcoin airdrop opportunities requires a blend of meticulous research, prudent risk assessment, and a proactive approach to identifying promising projects. While the potential rewards can be substantial, the inherent risks necessitate a cautious and informed strategy. By diligently following the steps Artikeld, crypto enthusiasts can significantly improve their chances of successfully navigating this dynamic landscape and potentially reaping significant returns.

Remember, thorough due diligence is paramount to mitigating risks and ensuring a secure and profitable experience.

FAQ Insights

What are the legal implications of participating in Bitcoin airdrops?

The legal landscape surrounding cryptocurrency airdrops is still evolving and varies by jurisdiction. It’s crucial to understand the tax implications in your region, as airdrops may be considered taxable income. Consult with a legal and financial professional for personalized advice.

How can I protect myself from airdrop scams?

Never share your private keys or seed phrases. Verify the legitimacy of projects through independent research, checking for community activity, development history, and audits. Be wary of overly promising returns or airdrops requiring significant upfront investment.

What is the best way to store airdrop tokens?

Store your airdrop tokens in a secure hardware wallet or a reputable exchange, depending on your investment strategy and the token’s characteristics. Prioritize security measures like two-factor authentication.

Are all airdrops worth participating in?

No. Thoroughly research each project before participating. Consider factors like the project’s utility, team, community, and tokenomics. Not all airdrops offer significant long-term value.