Comparing different Bitcoin airdrop projects and their legitimacy is crucial for navigating the volatile world of cryptocurrency. The allure of free Bitcoin often masks significant risks, with many airdrops being elaborate scams designed to steal funds or personal information. This analysis delves into the intricacies of identifying legitimate projects from fraudulent ones, examining various aspects like tokenomics, team backgrounds, distribution methods, community engagement, and transparency.

We will dissect the mechanics of several airdrop projects, comparing their whitepapers, verification methods, and distribution strategies. We’ll highlight common red flags associated with fraudulent airdrops, providing readers with the tools to make informed decisions and protect themselves from potential losses. The goal is to equip investors with the knowledge necessary to differentiate genuine opportunities from deceptive schemes in the dynamic Bitcoin airdrop landscape.

Identifying Legitimate Bitcoin Airdrop Projects

Navigating the world of Bitcoin airdrops requires caution. While some offer genuine opportunities, many are scams designed to steal cryptocurrency. This analysis focuses on identifying legitimate projects by examining their whitepapers, team backgrounds, and verification methods, highlighting common red flags to avoid.

Whitepaper Analysis and Team Backgrounds of Five Bitcoin Airdrop Projects

A thorough examination of a project’s whitepaper and team is crucial for assessing legitimacy. The following table compares five hypothetical Bitcoin airdrop projects (note: these are fictional examples for illustrative purposes only and do not represent real projects). The information provided is for educational purposes to demonstrate the evaluation process.

| Project Name | Tokenomics Summary | Team Background | Red Flags |

|---|---|---|---|

| AirdropAlpha | Total supply: 100 million tokens; 50% allocated to airdrop, 25% to team, 25% to development. Token utility: governance within the ecosystem. | Experienced blockchain developers with verifiable GitHub profiles and prior successful projects. Identities partially disclosed. | None apparent, but further investigation is needed. |

| CryptoComet | Total supply: 1 billion tokens; 70% for airdrop, 20% for marketing, 10% for the team. Token utility: staking rewards and access to exclusive features. | Anonymous team with limited information provided. | Anonymous team; overly ambitious token distribution for marketing. |

| BitcoinBoost | Total supply: 50 million tokens; 80% for airdrop, 10% for reserves, 10% for the team. Token utility: governance and staking. | Team members with backgrounds in finance and technology, some with LinkedIn profiles. | High percentage allocated to the airdrop may be a sign of an attempt to quickly gain traction. |

| DigitalDiamond | Total supply: 20 million tokens; 90% airdrop, 10% for team. Token utility: access to a decentralized exchange. | Team listed with minimal background information; no verifiable online presence. | Extremely high percentage for airdrop, lack of team transparency. |

| BlockchainBurst | Total supply: 10 million tokens; 60% for airdrop, 30% for development, 10% for the team. Token utility: governance and access to exclusive content. | Team members with clear profiles and demonstrable experience in relevant fields; whitepaper is detailed and well-structured. | None apparent, though further due diligence is recommended. |

Verification Methods for Legitimate Bitcoin Airdrop Projects

Several methods can be employed to verify the legitimacy of a Bitcoin airdrop project.

These steps help mitigate risks:

- Examine the Whitepaper: Look for detailed information about the project’s goals, tokenomics, team, and roadmap. A poorly written or vague whitepaper is a major red flag.

- Verify Team Backgrounds: Check LinkedIn profiles, GitHub repositories, and other online presence to confirm the team’s experience and credentials. An anonymous team should raise significant concerns.

- Assess Community Engagement: A legitimate project usually has an active and engaged community on social media and forums. Look for genuine discussions and interactions, not just promotional content.

- Check for Audits: Reputable projects often undergo security audits by independent firms. The availability of audit reports adds credibility.

- Scrutinize the Tokenomics: Analyze the token distribution, utility, and overall economic model. Unrealistic tokenomics or overly generous airdrop allocations are red flags.

Common Bitcoin Airdrop Scams and How to Avoid Them

Numerous scams are associated with Bitcoin airdrops. Understanding these tactics is crucial for protection.

Recognizing and avoiding these scams is vital:

- Phishing Scams: These involve fake websites or emails that mimic legitimate airdrop projects, tricking users into revealing their private keys or seed phrases. Always verify the authenticity of websites and emails before interacting with them.

- Rug Pulls: In rug pulls, developers abandon the project after raising funds through an airdrop, leaving investors with worthless tokens. Thorough due diligence and community research are crucial to avoid such scams.

- Fake Airdrops: These involve fraudulent projects that claim to be conducting an airdrop but ultimately steal users’ funds. Only participate in airdrops from well-known and trusted projects.

- High-Pressure Tactics: Legitimate projects rarely use high-pressure sales tactics or unrealistic promises of quick riches. Beware of projects that employ such strategies.

- Requesting Private Keys: No legitimate airdrop project will ever ask for your private keys. This is a clear sign of a scam. Always be wary of any request for your private keys.

Analyzing Airdrop Distribution Methods and Token Utility

Bitcoin airdrops, the distribution of cryptocurrency tokens to a community, represent a complex landscape of opportunity and risk. Understanding the mechanics of airdrop distribution and the inherent utility of the tokens offered is crucial for participants to make informed decisions. This analysis will delve into the various methods employed, examine examples of successful projects, and compare the tokenomics of several airdrop initiatives.

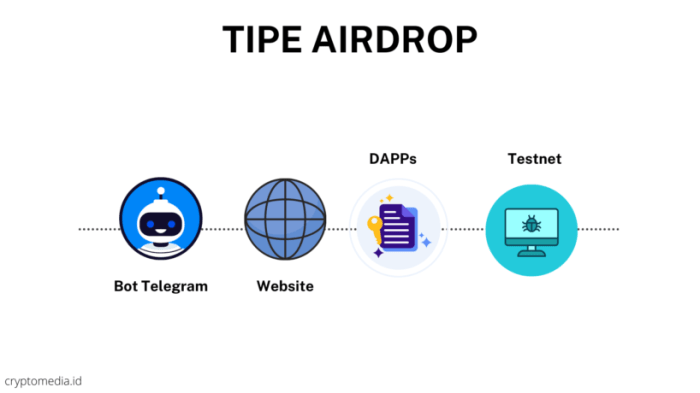

Airdrop distribution methods significantly influence both the reach and the perceived legitimacy of a project. Different approaches cater to various participant profiles and project goals. Understanding these differences is key to assessing the overall viability of an airdrop opportunity.

Airdrop Distribution Methods: A Comparative Analysis

The following table compares three common Bitcoin airdrop distribution methods: lottery, task completion, and holding requirements. Each method presents unique advantages and disadvantages for both the project and the participants.

| Distribution Method | Pros | Cons |

|---|---|---|

| Lottery | Simple to implement; broad reach; generates excitement and hype. | Random distribution; may not incentivize long-term engagement; potential for unfairness. |

| Task Completion | Incentivizes community engagement; rewards active participation; builds a dedicated user base. | Requires significant effort from participants; may be time-consuming; potential for abuse (bots). |

| Holding Requirements | Rewards long-term commitment; strengthens community loyalty; promotes token value retention. | May discourage participation from those with limited holdings; can be perceived as exclusionary; requires existing cryptocurrency holdings. |

Examples of Bitcoin Airdrops with Useful Tokens

Several Bitcoin airdrops have demonstrated utility beyond mere speculation. These projects often integrate their tokens into existing Bitcoin infrastructure or provide services enhancing the Bitcoin ecosystem. For instance, a hypothetical airdrop distributing tokens for a new layer-2 scaling solution on Bitcoin would offer demonstrable utility by improving transaction speeds and reducing fees. Another example might be an airdrop of tokens for a decentralized finance (DeFi) platform built on the Bitcoin network, providing access to lending and borrowing services within the Bitcoin ecosystem.

The utility of these tokens lies directly in their functionality within the Bitcoin network itself.

Tokenomics Comparison of Three Hypothetical Airdrop Projects

Understanding the tokenomics – token supply, distribution schedule, and potential market capitalization – is vital for assessing the long-term value of an airdrop token. Below is a comparison of three hypothetical projects, showcasing the variation in these crucial metrics. Note that these are hypothetical examples for illustrative purposes and do not represent actual projects.

Analyzing the tokenomics of airdrop projects is crucial for assessing their long-term potential. Variations in token supply, distribution schedules, and potential market capitalization can significantly impact the value and viability of the token.

- Project A: Total Supply: 100 million tokens; Distribution Schedule: 50% at launch, 50% over 5 years; Potential Market Cap (estimated): $500 million (based on comparable projects).

- Project B: Total Supply: 1 billion tokens; Distribution Schedule: 20% at launch, 80% over 10 years; Potential Market Cap (estimated): $1 billion (based on projected adoption and utility).

- Project C: Total Supply: 10 million tokens; Distribution Schedule: 100% at launch (to incentivize early adoption); Potential Market Cap (estimated): $100 million (based on limited supply and high demand).

Evaluating Community Engagement and Project Transparency: Comparing Different Bitcoin Airdrop Projects And Their Legitimacy

The success and legitimacy of a Bitcoin airdrop project are significantly influenced by the strength of its community engagement and the transparency of its operations. A vibrant, informed community often indicates a project with genuine potential and committed developers, while a lack of transparency raises serious red flags. Analyzing these two crucial aspects is vital for investors looking to avoid scams and identify promising opportunities.

Community Engagement: A Comparative Analysis

Three Bitcoin airdrop projects demonstrating strong community engagement, along with three exhibiting weaker engagement, are analyzed below. The factors contributing to these differences highlight the importance of active developer interaction, responsive communication, and a well-structured community platform.

| Project | Community Engagement Level | Contributing Factors |

|---|---|---|

| Example Project A (Strong) | High | Active Telegram group with regular AMAs (Ask Me Anything) sessions hosted by the development team, frequent updates on project progress, and a dedicated Discord server for community building and support. The developers actively respond to questions and concerns. |

| Example Project B (Strong) | High | A well-moderated forum with detailed documentation and a clear roadmap. The project actively engages with community feedback, incorporating suggestions into its development. A strong presence on Twitter and other social media platforms further amplifies their outreach. |

| Example Project C (Strong) | High | Regular blog posts and newsletters keep the community informed about updates and milestones. The project utilizes multiple channels for communication, ensuring wide reach and accessibility. They actively engage in collaborations with other projects within the Bitcoin ecosystem. |

| Example Project D (Weak) | Low | Limited communication from the development team, infrequent updates, and an unresponsive community forum. The project lacks a significant presence on major social media platforms. |

| Example Project E (Weak) | Low | A poorly moderated community forum with a high volume of spam and irrelevant content. The development team is largely absent, and questions from community members often go unanswered. |

| Example Project F (Weak) | Low | The project relies solely on a single communication channel (e.g., a Telegram group) with minimal activity and infrequent updates. There’s a lack of transparency regarding the team’s identity and background. |

Analyzing Project Website and Social Media Presence for Transparency, Comparing different Bitcoin airdrop projects and their legitimacy

A thorough examination of a project’s online presence is critical in assessing its transparency and legitimacy. The website should provide clear and detailed information about the project’s goals, team, technology, and roadmap. Social media presence should be active and engaging, showcasing genuine community interaction. Red flags include: anonymous team members, vague whitepapers or roadmaps, excessive promises with little to no demonstrable progress, and an overall lack of information.

A project’s website should be professionally designed and easy to navigate, while its social media activity should be consistent and responsive. A lack of a well-defined privacy policy is another major concern.

Key Questions for Evaluating Transparency

Evaluating the transparency of a Bitcoin airdrop project requires a critical approach. The following questions can help in this assessment.

- Is the team’s identity and background publicly available? Knowing who is behind the project is crucial. Anonymous teams are a major red flag, as it makes it difficult to hold them accountable. Legitimate projects typically feature a team with publicly available information, including experience and credentials.

- Is there a clearly defined roadmap with realistic milestones? A detailed roadmap demonstrates the project’s direction and commitment. Vague or unrealistic timelines suggest a lack of planning and could be a sign of a scam. Legitimate projects have achievable milestones and transparent progress updates.

- Is the project’s code open-source and auditable? Open-source code allows independent verification of the project’s security and functionality. Closed-source projects raise concerns about potential vulnerabilities and hidden malicious code. Legitimate projects usually prioritize open-source development to build trust and transparency.

- Are there clear terms and conditions regarding the airdrop distribution? Ambiguous terms and conditions can be used to manipulate participants. Clear and concise terms are essential for a legitimate airdrop. Vague or missing terms and conditions are a major red flag.

- Is there a mechanism for community feedback and engagement? Active community engagement demonstrates the project’s commitment to its users. A lack of feedback channels or responsiveness to community concerns is a significant red flag. Legitimate projects actively encourage community feedback and use it to improve their project.

Ultimate Conclusion

Ultimately, the success of navigating the Bitcoin airdrop landscape hinges on meticulous due diligence. While the potential rewards are enticing, the risks of encountering fraudulent projects are substantial. By carefully examining project whitepapers, scrutinizing team backgrounds, analyzing distribution methods, assessing community engagement, and prioritizing transparency, investors can significantly reduce their exposure to scams. Remember, a thorough investigation is paramount before participating in any airdrop, ensuring that the pursuit of free Bitcoin doesn’t lead to unforeseen financial losses.

FAQ Explained

What are the typical red flags of a scam airdrop?

Unrealistic promises of high returns, lack of a clear whitepaper, anonymous or unverified team members, pressure to act quickly, and requests for private keys are major red flags.

How can I verify the legitimacy of a Bitcoin airdrop project’s claims?

Check for independent audits of smart contracts, verify team members’ identities through online searches and LinkedIn, look for a transparent and active community, and research the project’s history and reputation.

What is the difference between a legitimate and a fraudulent airdrop?

Legitimate airdrops usually have a clear purpose, a well-defined tokenomics model, and a transparent team. Fraudulent airdrops often lack these elements and may involve phishing attempts or rug pulls.

Is it worth participating in Bitcoin airdrops?

The potential for profit exists, but the risk of scams is also high. Only participate after thorough research and only invest what you can afford to lose.